1. Legal Framework Differentiating Employees From Independent Contractors

a. Factors that Determine Who is an Employee and Who is an Independent Contractor

An employee is defined by the Brazilian Labor Code (CLT) as an individual who renders services to an employer on a permanent basis, under its direction and for a salary. Professional subordination of the employee to the employer is essential in an employment relationship.

On the other hand, an independent contractor relationship is regulated by the Brazilian Civil Law, which establishes that any company may enter into a contract with an individual to render services as an independent contractor. A consultant hired as an independent contractor would and should be free to determine how and when the work is performed. An independent contractor does not usually perform work that is necessary for the company on a permanent basis.

Brazilian Labor courts have determined that factors, which indicate subordination include the lack of self-determination to decide how the work should be done; the control of hours of work; and the obligation to present reports and to observe previous targets.

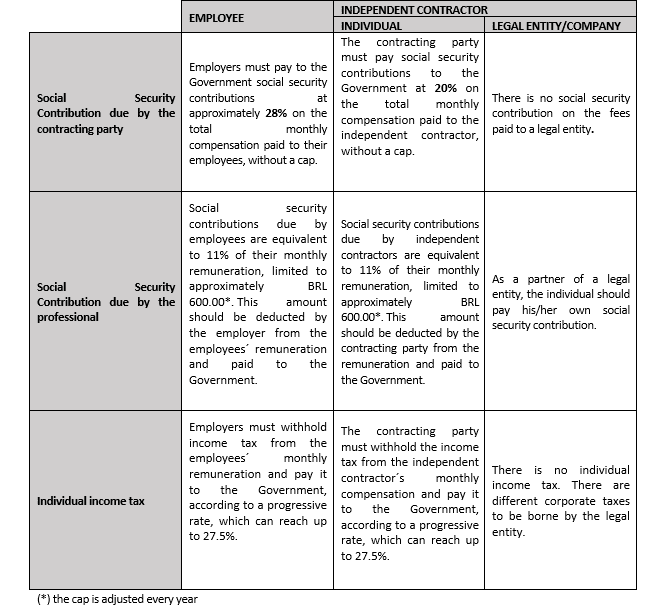

b. General Differences in Tax Treatment

Independent contractors may act either as an individual or as a legal entity duly incorporated by the individual, leading to different taxation and obligations. By law an employee must be an individual. Depending on the alternative, the social security and taxation differ as follows:

c. Differences in Benefit Entitlement

Independent Contractor

In a relationship with an independent contractor, the parties are free to negotiate the terms and conditions, including possible benefits and any other conditions. There is no minimum remuneration or conditions, which must be observed by the parties.

Employees

In an employment relationship, the employer must observe the minimum conditions established by law and by the applicable collective bargaining agreement. Employers and employees are all mandatorily represented by a specific union in Brazil. Among the oblig-atory labor rights and obligations it is worth highlighting:

- i. FGTS – Severance Pay Fund: all employers in Brazil must deposit an amount equivalent to 8% of the employees’ monthly compensation into a special account opened with the Federal Savings Bank on behalf of each of the employees. This special account is the FGTS (severance pay fund).

In the event of termination without cause, retirement, or serious illness, among other si-tuations, the employee is entitled to withdraw the balance of the FGTS account including any additional termination indemnification, as the case may be. - ii. Annual Paid Vacation: after each 12-month working period, an employee is entitled to 30 days' paid annual leave, which must be taken within the subsequent period of 12 months. In addition to the ordinary pay over the period of annual leave, the employee is entitled to receive a vacation bonus equivalent to one-third of his/her [annual] compensation.

- iii. 13th month Salary or Christmas Bonus: besides the annual salary paid over 12 months, employees in Brazil are entitled to a 13th month salary (Christmas bonus) at the end of the year.

- iv. Transportation voucher: employees who use the public transport system to commute between home and the workplace are entitled to transportation vouchers.

- v. Working hours: any regular working period may not exceed eight hours per day and 44 hours per week. Overtime is permitted provided employees are duly remunerated with an additional amount equivalent to at least 50% of their normal work-hour rate and provided the total work hours do not exceed 10 hours per day. Employees in a position of trust (such as management) are not entitled to overtime, nor are they subject to controlled working time. Certain special categories have a shorter limit of daily working hours.

- vi. Other benefits: Although they are not compulsory by law, it is common market practice in Brazil to grant meal vouchers and health care. It is also common practice to provide private pension plans, life insurance and education allowances. Collective bargaining agreements may provide for additional compulsory benefits. Employee benefits and conditions are vested rights, and employers are prevented from changing employment terms and conditions to the employee's determent, whether or not the employee has previously consented to such change.

d. Differences in Protection from Termination

Independent Contractor

In a relationship with an independent contractor, the parties are free to negotiate the terms and conditions, including a termination process (types of termination, with or without cause, prior notice, post-termination conditions, etc.). According to the Civil Code, an independent contractor agreement can be terminated by any party, by giving the other party prior notice of a minimum of:

- eight days if the remuneration is paid on a monthly basis;

- four days if the remuneration is paid on a weekly or fortnight basis;and

- one day if the contract is valid for less than seven days.

Any other conditions should be negotiated by the parties. It is common practice for the parties to negotiate a minimum 30 day notice period. Employees

Employees

Employment contracts in Brazil are usually for an indefinite term. An employer may ter-minate an employment agreement at any time, with or without cause, and an employee can also resign at any time.

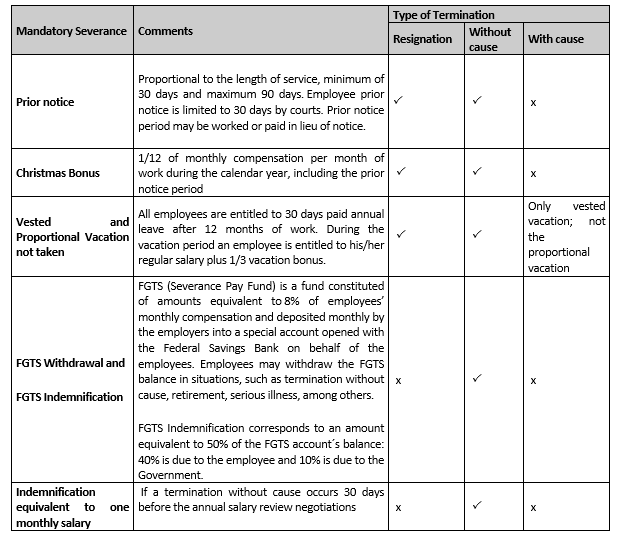

The party terminating the employment contract must give notice to the other party, both in the case of resignation or termination without cause. Minimum notice to be given by the employer depends on length of service: 30 days' notice for employees with up to one year of service at the same company, plus three days for each additional year of service, subject to a maximum of 90 days. Prior notice to be given by employees to their employer has been limited to 30 days by the courts.

Termination for cause must be based on misconduct established by law and does not require prior notice.

Employees whose circumstances put them in a position of "temporary job instability" cannot be dismissed without cause, e.g. union representatives, the members of the Internal Committee for Accident Prevention (CIPA), expectant mothers and employees injured due to workplace accidents, among other specific situations.

The table below sets out the various mandatory severance payments due to an em-ployee. Entitlement to these payments varies depending on the mode of termination, whether by resignation / termination with or without cause.

In addition to the above, collective bargaining agreements may establish additional termination rights.

e. Local Limitations on Use of Independent Contractors

Any company may enter into a contract with an individual to render services as an in-dependent contractor, provided the subject of the contract is legal according to the Brazilian Civil Law. There are certain activities that should be performed exclusively by professionals duly enrolled in the respective professional council, such as engineers and lawyers, among others.

The contracting party and the independent contractor may freely negotiate the agre-ement, including terms, fees and other conditions provided the relationship was not established to disguise an employment relationship. The fees must be set and paid in Brazilian currency.

f. Other Ramifications of Classification

There is no prohibition on the use of independent contractors; however, if the elements of the employment relationship are present (services rendered on a personal basis; on a permanent/habitual basis; with subordination, i.e., the services are rendered under the direction of a supervisor; and on an onerous basis, i.e., the individual must receive remuneration in consideration for the services rendered), the independent contractor may be reclassified as an employee.

g. Leased or Seconded Employees

The Brazilian Superior Labor Court has ruled that it is illegal to hire employees through an intermediary. If this is done, an employment relationship will be formed with the inter-mediary contracting company, except if the employees are temporary workers. Tempo-rary workers in Brazil are regulated by Law 6,019/1974, which provides that temporary workers can be engaged in the following situations:

- to substitute regular employees for a temporary term (i.e during maternity/sick leave); or

- due to a substantial increase in the workload of the company (e.g toy industry over the Christmas period or a company that assumes a new client and will need extra personal for a specific term to assist with the organization of the documents of such new client).

A temporary worker is hired through a specialized agency, duly registered with the Mini-stry of Labor. It is a three-party relationship comprising:

- the temporary work agency, (the employer);

- the contracting company (the client); and

- the worker (the temporary employee).

The services agreement for an employee between the client and the temporary work agency cannot exceed three months, except if authorized by the Ministry of Labor, when the agreement may be extended:

- to a maximum of six months in the event of a substantial increase in the workload of the company; and

- to a maximum of nine months as a result of substitution of regular employees for a temporary term

The client will always be secondarily liable for the labor and social security debts of any temporary employee who renders services to the company. Thus, if the temporary wor-ker agency does not comply with the labor and social security law, the client may be held responsible for such debts.

The temporary worker is entitled to the same remuneration and benefits as the regular employees of the client despite the fact that the temporary employee will be an em-ployee of the agency and not of the client.

The process of outsourcing in Brazil may be unique when compared to other countries. Outsourcing of the core business of a company is not permitted. There is no specific pro-vision of law governing outsourcing, however Precedent 331 of the Superior Labor Court prevails in practically all cases. Secondary activities of a company can be outsourced, for instance cleaning and security activities (for companies which do not have the cleaning and security activities as a core business) and accountancy services (for non accountant companies).

h. Regulations of the Different Categories of Contracts

There are several special regulations applicable to different categories of employees, specifically fixed term employees, part time employees, disabled employees, appren-tices, pregnant employees, minimum wages for employed engineers, special conditions for employed drivers, domestic workers, rural workers, airplane crew, offshore activi-ties, journalists, employed soccer players, among others.

Federal laws also regulate different categories of workers who do not act as employees, such as interns/students and commercial sales representatives.